The Foreign Agents Registration Act (FARA) has long been a thorn in the side of K Street lobbyists, corporate public affairs teams, and international nonprofits operating in the U.S. Originally passed in 1938 to counter Nazi propaganda, FARA has evolved into a sweeping disclosure law designed to track foreign influence efforts. However, under Attorney General Pam Bondi, the Trump administration is moving to gut FARA enforcement—prioritizing “espionage-related” cases while rolling back broad transparency mandates.

This shift comes as the Department of Justice (DOJ) finalizes a significant overhaul of FARA regulations, reshaping the compliance landscape for lobbying firms, multinational corporations, and nonprofits with foreign ties.

Does this deregulation reduce compliance headaches, or does it open the floodgates to foreign influence with little oversight?

1. Key Changes Under Bondi’s DOJ

A. Biden DOJ's Last Minute Rule Tightening

The DOJ released a Notice of Proposed Rulemaking (NPRM) in January 2025 that redefined what qualifies for exemption under FARA. The most contentious change was the introduction of a "totality-of-the-circumstances" test, which replaces the prior bright-line exemptions for commercial and legal activities.

The DOJ explicitly excluded FARA exemptions for activities that:

Promote a foreign government’s or political party’s interests.

Are influenced by foreign governments or political parties.

Primarily benefit foreign governments.

Involve entities supervised or financed by foreign governments.

These changes would make it significantly harder for organizations to claim that their lobbying or PR work falls outside FARA’s purview.

B. Enforcement Rollback: From Transparency to Espionage

While the NPRM expands who qualifies as a foreign agent, AG Bondi’s DOJ enforcement pivot does the opposite—narrowing enforcement efforts to “traditional espionage” cases. Specifically:

The Foreign Influence Task Force (FITF) has been disbanded. This unit was responsible for cracking down on undisclosed foreign lobbying.

Corporate enforcement has been deprioritized, with resources reallocated to cartel-related FCPA cases instead.

DOJ has deprioritized FARA-based prosecutions for undisclosed PR and lobbying efforts, signaling fewer cases against consulting firms and former government officials working on behalf of foreign clients.

C. Targeting FARA Compliance Through Advisory Opinions

The DOJ has acknowledged that the "totality" test remains vague and plans to issue advisory opinions on a case-by-case basis. This signals an intention to test legal boundaries through enforcement cases, rather than provide clear-cut compliance guidance.

Why this matters:

Many lobbying firms and multinationals now operate in a gray zone, unsure if their work will be considered FARA registrable.

DOJ’s case-by-case approach means companies and law firms may become test cases before clear compliance standards emerge.

The legal industry is particularly vulnerable—as the revised legal exemption now excludes non-legal activities like lobbying and PR even when conducted by attorneys.

2. Implications for Key Stakeholders

A. U.S. Lobbying and PR Firms: Loopholes, But More Scrutiny

For K Street’s major lobbying and PR firms, the rollback in enforcement is a clear win. Less scrutiny means:

Easier pathways to work with foreign clients without the stigma of FARA registration.

Fewer investigations into undisclosed lobbying efforts, including work for foreign sovereign wealth funds and state-backed corporations.

Lower compliance costs, as fewer firms will need to preemptively register under FARA.

However, this deregulation is a double-edged sword. The increased regulatory ambiguity could make firms more susceptible to retroactive enforcement. If a future administration reinstates FARA crackdowns, firms operating in this gray area may be exposed to major legal and reputational risks.

B. Multinational Corporations: Higher FARA Risk in the Gray Zone

For Fortune 500 companies with global lobbying operations, the commercial exemption revision is a major concern. Previously, corporate advocacy efforts were often shielded under the “commercial” exemption if they were not explicitly political. Now:

Global corporations may need to register under FARA if their work “predominantly serves” foreign interests.

Trade associations and business councils with foreign funding could face new scrutiny.

Foreign state-owned enterprises (SOEs)—such as energy, defense, or telecom firms—will struggle to avoid FARA registration for their U.S. lobbying.

In short, corporate government affairs teams now face a more complex and uncertain FARA compliance landscape.

C. Nonprofits & Advocacy Groups: Chilling Effect or Strategic Opportunity?

For international NGOs and nonprofit advocacy groups, the FARA revision introduces serious risks:

Foreign-funded nonprofits may be reclassified as foreign agents if they engage in U.S. political advocacy.

Human rights and pro-democracy groups operating in authoritarian states could face new compliance burdens.

Legal defense funds for foreign nationals could face new restrictions under the narrowed legal exemption.

However, for conservative think tanks and advocacy organizations with foreign donors, the DOJ’s enforcement rollback offers a strategic opening. These groups may find it easier to engage in policy influence activities without registering under FARA.

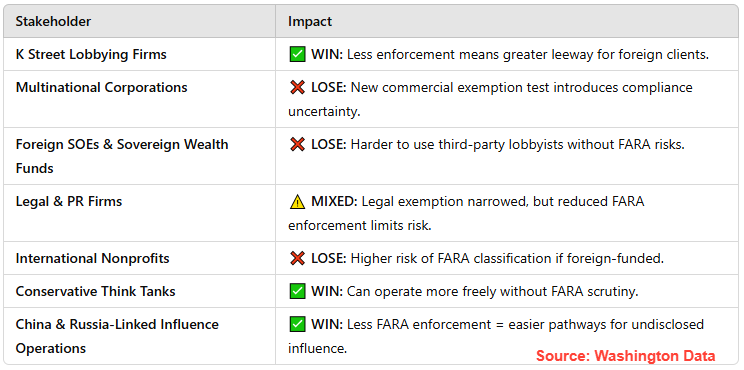

3. Who Benefits and Who Loses?

Temporary Deregulation or Long-Term Shift?

The Trump administration’s FARA overhaul represents a fundamental shift—one that prioritizes espionage-related foreign influence while de-emphasizing transparency enforcement. In the near term, this shift offers relief to K Street and corporate public affairs teams but creates significant compliance uncertainty for multinationals and nonprofits.

However, if political winds shift in 2029 or beyond, we could see a sharp regulatory reversal—with firms operating in today’s “gray zone” becoming prime targets for retroactive FARA enforcement. For now, U.S. lobbying firms, global corporations, and advocacy groups must navigate a highly ambiguous compliance environment, balancing short-term deregulation benefits against long-term legal risks.

Sources and Further Reading

DOJ FARA Regulatory Overhaul – National Law Review. Will FARA Get a Facelift? DOJ Proposes Updated Regulations for the First Time in 15 Years. Link

Proposed Changes to FARA Exemptions – JD Supra. DOJ Announces Significant Proposed FARA Amendments Narrowing Exemptions. Link

Foreign Agent Law Changes – The Hill. Foreign Agent Law Faces Sweeping Changes Under New Regulations. Link

Bondi’s DOJ Enforcement Rollback – Bloomberg Law. Bondi Scales Back U.S. Justice Department’s White-Collar Enforcement. Link

FARA Compliance Uncertainty – King & Spalding. Proposed FARA Changes Will Result in More Questions Than Answers. Link

DOJ’s New FARA Regulations – Morrison & Foerster. DOJ Proposes Significant Changes to FARA’s Regulations. Link

Foreign Influence Policy Shift – Yahoo News. An Invitation for Foreign Actors? Bondi Tells DOJ to Back Off. Link

Long-Awaited FARA Proposal – Mayer Brown. U.S. Department of Justice Issues Long-Awaited Proposal to Revamp FARA Regulations. Link

Key Issues in FARA 2025 – Mayer Brown. The U.S. Foreign Agents Registration Act: Key Issues to Watch in 2025. Link

New Compliance Risks Under FARA – Nossaman LLP. U.S. DOJ Proposes FARA Amendments to Narrow Exemptions for Commercial Lobbying. Link

Undisclosed Foreign Consulting Services – Citizen.org. Kash Patel’s Failure to Register as a Foreign Agent Must Be Investigated. Link

Modernizing FARA Enforcement – Morgan Lewis. DOJ’s Latest Attempt at Modernizing FARA Signals Greater Focus on Compliance and Enforcement. Link

FARA’s Impact on Corporate Compliance – Reuters. Corporate Lessons from Recent Foreign Influence Prosecutions. Link

Bondi’s DOJ Shake-up – Bloomberg Government. Bondi Confirmed as Trump’s Attorney General to Lead DOJ Shake-Up. Link

New DOJ FARA Regulations Review – MoFo Insights. Lawfare Daily: The Proposed New FARA Regulations. Link

FARA Rule Complications – O’Melveny & Myers LLP. Proposed FARA Rule Complicates Compliance and Suggests Aggressive Enforcement Will Continue. Link

This is what I was thinking…