FCPA Overhaul Makes Foreign Bribery Great Again

Green Light for Corporate Corruption or a National Security Policy?

Green Light for Corporate Corruption or a National Security Policy?

The Trump administration’s deregulatory crusade has taken a bold new step under Attorney General Pam Bondi, redefining the enforcement priorities of the Foreign Corrupt Practices Act (FCPA). Historically, the FCPA has been the cornerstone of U.S. anti-bribery efforts, holding multinational corporations accountable for paying off foreign officials. However, a new DOJ directive issued on February 5, 2025, dramatically narrows the scope of enforcement—shifting focus from traditional corporate corruption to transnational criminal organizations (TCOs), particularly drug cartels and human smuggling networks.

This move abandons long-standing corporate anti-corruption efforts, triggering concerns that foreign bribery schemes in key industries—energy, defense, healthcare, and finance—will now flourish unchecked. But proponents argue that refocusing on cartel-linked corruption aligns with national security priorities.

The key question: Is this a strategic reprioritization or an open invitation for corporate bribery?

1. Breaking Down Bondi’s FCPA Overhaul

A. A Hard Pivot to Cartel-Linked Corruption

The new DOJ directive deprioritizes corporate bribery prosecutions unless they are directly linked to drug cartels, human smuggling, or firearms trafficking. Specifically:

DOJ will now prioritize FCPA cases where bribes are paid to foreign officials in connection with cartels or TCOs, including:

Bribes to facilitate human smuggling, such as payments to foreign border officials.

Bribes to enable drug and arms trafficking, including payments to port and customs officials.

Traditional corporate bribery cases—such as paying government officials to win contracts—are no longer an enforcement priority.

Why this matters:

For the first time since the FCPA’s passage in 1977, corporate corruption not tied to organized crime is effectively decriminalized at the federal level.

B. Procedural Changes: Decentralizing FCPA Enforcement

The DOJ has removed centralized oversight of FCPA cases, instead:

Allowing U.S. Attorneys’ Offices to prosecute cartel-linked FCPA cases without approval from the DOJ’s Fraud Section.

Eliminating the need for pre-authorization from the Criminal Division, reducing DOJ oversight on whether cases move forward.

This fragmented approach could lead to wildly inconsistent enforcement across jurisdictions.

C. Resource Reallocation: Corporate Oversight Defunded

The Kleptocracy Asset Recovery Initiative and Task Force KleptoCapture—units responsible for tracking corrupt foreign assets—have been disbanded.

Resources have been redirected to cartel-related financial crimes, with a focus on MS-13, Tren de Aragua, and other TCO-linked networks.

Bottom line:

The DOJ no longer sees corporate corruption as a stand-alone threat—only cases tied to national security concerns (cartels, terrorism, and human trafficking) will receive attention.

Major multinational corporations now operate in a gray zone where bribery laws may no longer be enforced.

2. Implications for Key Sectors

A. U.S. Lobbying & PR Firms: The “Foreign Bribery Loophole”

Washington’s K Street lobbying firms and PR agencies have historically navigated FCPA risks carefully when representing foreign governments and state-owned enterprises. Now, with the corporate corruption crackdown abandoned, lobbying and PR firms may:

Expand their foreign influence activities without fearing FCPA scrutiny.

Take on riskier clients, including foreign sovereign wealth funds and state-owned companies from China, Russia, and the Gulf States, with fewer legal repercussions.

Exploit the DOJ’s cartel carveout—lobbying for non-criminal foreign governments now operates in a regulatory gray zone.

Big picture:

The U.S. may become a global hub for undisclosed foreign lobbying and influence operations, reducing transparency on how foreign powers shape American policy.

B. Multinational Corporations: A Hall Pass for Bribery?

For Fortune 500 companies engaged in global business, the Bondi memo represents a major regulatory rollback.

Industries previously under DOJ scrutiny for FCPA violations—such as energy, defense, and healthcare—will face minimal enforcement risks.

Foreign corrupt payments to secure business deals will likely see a resurgence, as DOJ has deprioritized enforcement outside cartel-related cases.

Mexico-facing industries—logistics, infrastructure, and automotive—may face new risks, as bribery cases linked to cartel influence could still be prosecuted.

C. Nonprofits & Advocacy Groups: Collateral Damage?

International nonprofits and advocacy groups working in corruption-prone regions (e.g., Latin America, Africa, and Eastern Europe) face a dangerous new reality:

Humanitarian organizations with foreign government funding may face unexpected FCPA scrutiny if tied to alleged cartel activity.

U.S.-based NGOs advocating for anti-corruption reform could lose a key enforcement tool, making foreign governments less accountable.

Foreign aid programs that previously relied on FCPA oversight to prevent misappropriation will have fewer safeguards.

The concern:

The rollback could weaken international anti-corruption frameworks, including the OECD Anti-Bribery Convention and United Nations Convention Against Corruption (UNCAC).

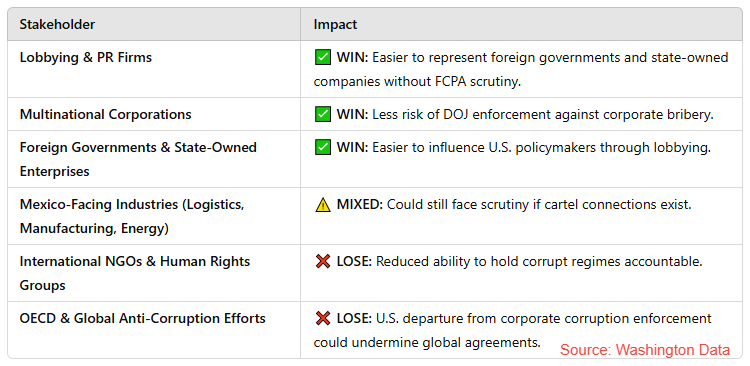

3. Who Benefits, Who Loses?

4. Is This the End of Corporate FCPA Enforcement?

With the Bondi DOJ dismantling corporate corruption oversight, the U.S. is experiencing the most radical shift in FCPA enforcement since its inception. The administration frames this move as a national security priority—claiming that targeting cartel-linked bribery is a more effective use of federal resources.

However, critics argue this opens the floodgates for unchecked corporate corruption, creating a de facto "safe harbor" for foreign bribery.

Sources and Further Reading

DOJ FCPA Overhaul Memo – U.S. Department of Justice. Attorney General Bondi Issues Directive Limiting Scope of FCPA Enforcement. Link

Treasury Sanctions & Cartel Designations – U.S. Department of Treasury. Treasury Designates Foreign Terrorist Organizations Linked to Mexican Cartels. Link

Bondi’s DOJ Enforcement Rollback – Bloomberg Law. Bondi Scales Back U.S. Justice Department’s White-Collar Enforcement. Link

FCPA Reform Analysis – Debevoise & Plimpton. FCPA Update: Bondi’s DOJ Narrows Corporate Anti-Bribery Focus. Link

FCPA Policy Shifts and National Security – U.S. Department of Treasury. Revised DOJ Priorities for Foreign Bribery Enforcement. Link

Mexican Cartels as Foreign Terrorist Organizations – JD Supra. Implications of Cartel FTO Designations on U.S. Business Operations. Link

Bondi’s FCPA Memo & Corporate Prosecutions – Foley Hoag LLP. AG Bondi Overhauls FCPA Enforcement in Day-One Memo. Link

U.S. Anti-Corruption Strategy Shift – Bloomberg Law. Bondi’s DOJ Rolls Back Corporate Corruption Prosecutions. Link

OECD Anti-Bribery Convention Risks – WilmerHale. FCPA Year in Review 2024: Developments and Predictions for 2025. Link

Global Bribery and Corruption Outlook – Hogan Lovells. 2025: A Year of Change in Bribery and Corruption Enforcement. Link

DOJ Corporate Crime Focus Shift – MLex. Bondi Deprioritizes U.S. Anti-Corruption Corporate Criminal Enforcement. Link

Implications for Mexican Banks and Finance – Paul Hastings LLP. Mexican Cartel Designations as FTOs: Risks for Financial Institutions. Link

Cartel Terror Designations and Business Risk – Atlantic Council. Mexican Cartels as Foreign Terrorist Organizations: Impact on U.S. Businesses. Link

Intersection of FCPA and Antitrust Violations – U.S. Department of Justice. International Cartels and the FCPA: Overlapping Risks for Corporations. Link

Corporate Bribery Trends Under Bondi DOJ – Covington & Burling LLP. What to Watch for in FCPA Enforcement in 2025. Link

Anti-Corruption Enforcement in the Americas – DLA Piper. How Cartel Enforcement is Evolving Across the Americas. Link

Foreign Lobbying and Corporate Bribery Loopholes – Salon. Bondi’s DOJ Tells Prosecutors to Quit Worrying About Foreign Lobbying. Link

Trump-Era White Collar Enforcement Strategy – Vinson & Elkins LLP. White Collar and Corporate Criminal Enforcement in the Trump 2.0 Era. Link

Human Smuggling and Cartel Financing Risks – Money Laundering News. FinCEN Issues Alert on Human Smuggling and Trafficking Along the Southwest Border. Link

Trump DOJ Policy Changes on White Collar Crime – Morgan Lewis. Newly Confirmed AG Pam Bondi Issues Directive Limiting FCPA Enforcement. Link